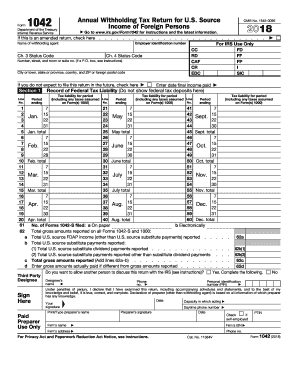

IRS 1042-S 2018 free printable template

Instructions and Help about IRS 1042-S

How to edit IRS 1042-S

How to fill out IRS 1042-S

About IRS 1042-S 2018 previous version

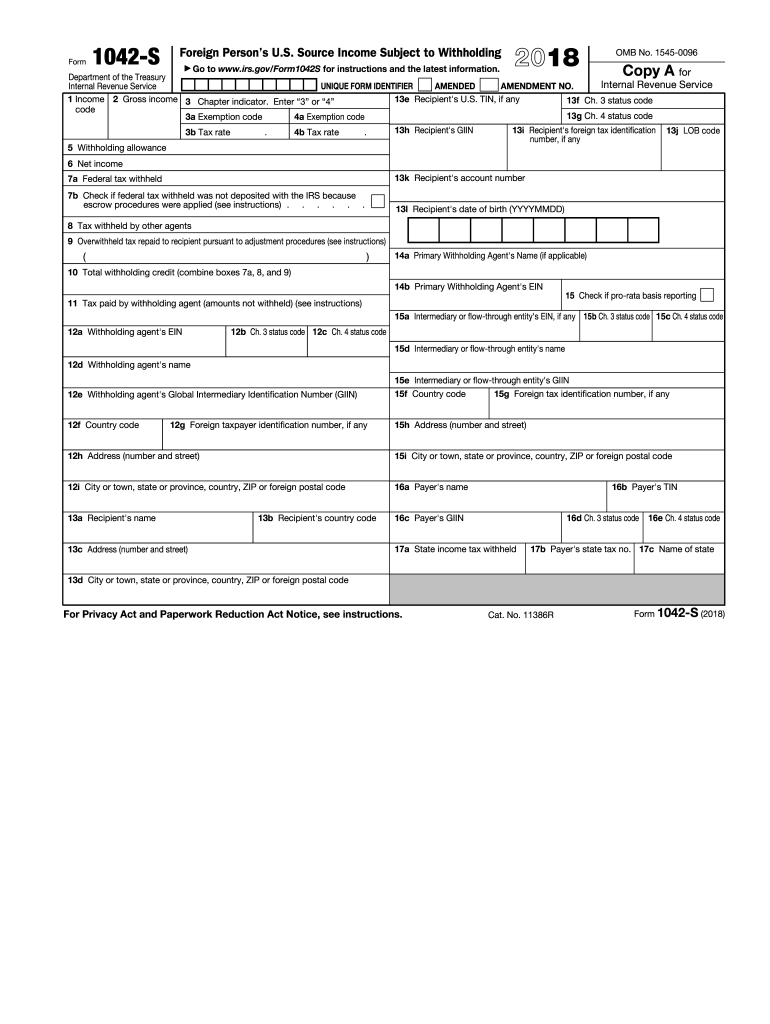

What is IRS 1042-S?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042-S

How can I correct mistakes made on a submitted form 1042 s 2017?

If you need to correct mistakes on your form 1042 s 2017 after submission, you should file an amended form indicating the corrections made. Ensure to include an explanation of the errors and the necessary adjustments to avoid penalties and clarify any discrepancies.

What steps should I take to verify if my form 1042 s 2017 has been received?

To verify the receipt of your form 1042 s 2017, you can check the status online if you filed electronically or contact the IRS directly if you submitted by mail. Be prepared with your details for a smoother inquiry, including the filing date and payment information.

What should I do if I received a notice regarding my form 1042 s 2017?

If you receive a notice related to your form 1042 s 2017, promptly read through it to understand the issue. Gather any required documentation to respond, and comply with the instructions, which may involve amending your filing or providing additional information to resolve the matter.

What common errors should I be aware of when filing form 1042 s 2017?

Be mindful of common errors such as incorrect payee information and mismatched amounts between forms. Double-check all entries before submission and consider utilizing tax software to minimize mistakes associated with calculations and data entry.